Joan’s Toolbox: Planned Giving — Make a Difference, Forever

Joan’s Toolbox is an occasional series in which Joan Hoge-North, DCF vice president for philanthropy, shares information about different ways of making charitable gifts that maximize impact and tax advantages.

What do you want to be remembered for?

If philanthropy is an important part of your life, you may want to think about how to extend your charitable work beyond your living years.

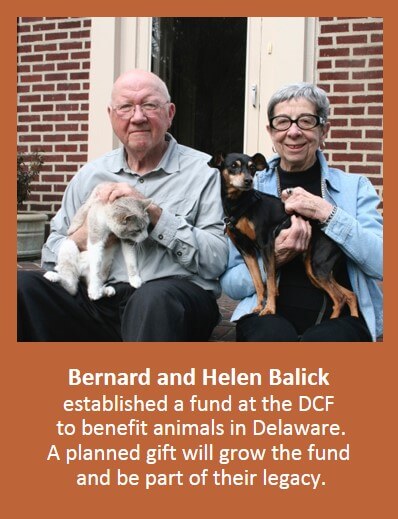

That’s what Bernard and Helen Balick did in 2003, establishing a fund at the Delaware Community Foundation (DCF) to help animals in Delaware.

The Balicks are members of the DCF’s Legacy Society, a group of thoughtful philanthropists who have incorporated giving into their estate plans. At the end of their lives, a portion of the couple’s estate will grow the fund and benefit animals in Delaware for generations to come.

Like the Balicks, you can provide a permanent stream of funding to your favorite charitable causes and organizations through a planned gift to the DCF. In many cases, legacy gifts also provide for immediate tax advantages and reduce estate taxes in the future.

The DCF team can help you maximize the impact of your charitable impact through tax-advantaged estate planning. In addition to our knowledge of philanthropic financial tools, we also have deep knowledge of Delaware – its communities, its strengths and challenges, and the organizations doing powerful work to continuously improve quality of life in the First State.

Planned giving includes many options, such as giving through wills or trusts, assigning beneficiaries of IRAs or life insurance policies, and more. In some cases, you can make a tax-advantaged charitable gift today that guarantees you a stream of income for the rest of your life.

The staff of the DCF works with interested donors to help plan their legacy giving, starting with identifying charitable causes and organizations they would like support through a later distribution of their estate assets. Our staff can discuss which giving options will allow donors to meet their philanthropic goals in the most financially prudent way.

By including charitable giving in your estate plans, you can continue to make a difference in Delaware well beyond your lifetime.

Contact Joan Hoge-North at 302.504.5224.